The Payroll Blog

Choosing to make your health a priority in the new year is a popular resolution for many. However, health can take on various forms that you may not be factoring into your resolutions.

- Home

- Resources

- Payroll Blog

- How Do I Run My Own Payroll

How Do I Run My Own Payroll

As a small business owner, hiring your first employee means that it's time to implement a payroll process.

Generally speaking, there are three ways to process payroll:

- Do it yourself

- Hire an accountant

- Use an online payroll service

In this guide, we explain the steps associated with running and managing your own payroll.

Payroll taxes consist of local, state, and federal taxes withheld from an employee's paycheck. The IRS provides an overview of employment taxes on its website, making note of:

- Federal Income Tax

- Social Security and Medicare Taxes

- Additional Medicare Tax

- Federal Unemployment Tax

Once you fully understand which taxes to withhold, as well as the rate associated with each one, you're in position to move forward.

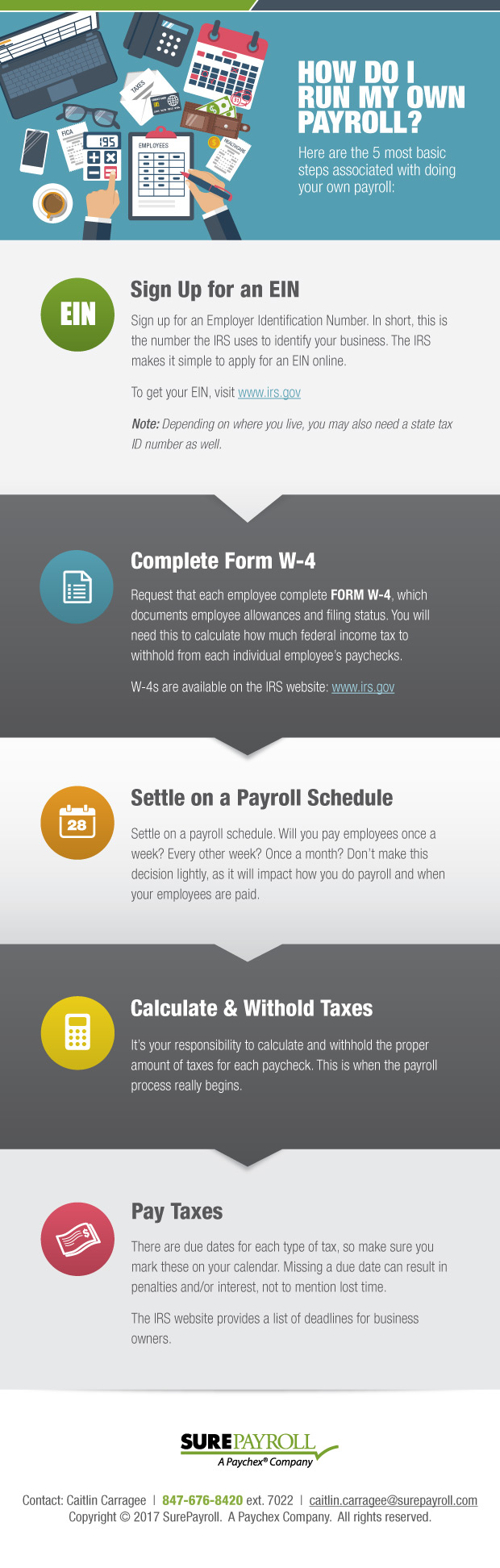

Here are the most basic steps associated with doing your own payroll (click here to download a checklist to help organize payroll details):

1. Sign up for an Employer Identification Number. In short, this is the number the IRS uses to identify your business. In some ways, it's the same as a Social Security number for an individual. The IRS makes it simple to apply for an EIN online.

Note: Depending on your state, you may also need to apply for a state tax identification number.

2. Request that each employee complete Form W-4. With this in hand, you can calculate how much federal income tax to withhold from your employee's paychecks. This documents the employee's allowances, as well as their filing status.

3. Settle on a payroll schedule. Will you pay employees once a week? Every other week? Once a month? Don't take this decision lightly, as it will impact how you do payroll and when your employees are paid.

Note: Payroll schedule is often dependent on state law and/or industry requirements so you will want to make sure that your schedule is aligned to appropriate regulations for your small business. This is also a good time to make note of important due dates and filing deadlines.

4. Calculate and withhold the proper amount of taxes. This is when the payroll process really begins. With each paycheck, it's your responsibility to calculate and withhold the correct amount of taxes.

5. Pay taxes. There are due dates for each type of tax, so make sure you mark these on your calendar. Missing a due date can result in penalties and/or interest, not to mention lost time.

Conclusion

As you can see, there is a lot that goes into doing your company's payroll. In addition to the five steps above, you may be responsible for completing a variety of other tasks.

With everything else you have on your plate running your small business, payroll might seem overwhelming. If it becomes too much to handle, it may be time to consider another option, like using an online payroll service.

We've put together a checklist to help you organize what information you'll need to run payroll, whether you manage the process in-house or use a payroll service provider. Download your copy here: How Do I Run Payroll Checklist

Ready to give it a try?

Join the thousands of small businesses and households that trust SurePayroll for fast, easy and accurate payroll processing - for free!

Not sure what you need?

Contact us to figure it out!

Call 855-354-6941