The Payroll Blog

Choosing to make your health a priority in the new year is a popular resolution for many. However, health can take on various forms that you may not be factoring into your resolutions.

- Home

- Resources

- Payroll Blog

- Renting Vs Buying

Renting vs Buying

Whether you are looking to expand your business out of your home office or simply set up shop for the first time, choosing a location is an exciting process. However, similar to your home or car, you may be struggling with a purchasing dilemma when it comes to your business – should you rent or buy?

Both options have their benefits, and consideration points, but one could make more sense than the other in terms of your business.

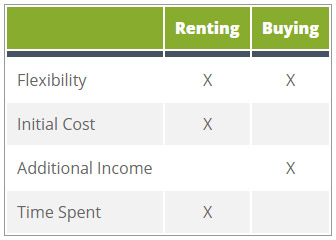

The chart below demonstrates the areas that each option has the more positive outcome.

Renting Pro: Flexibility – When renting you have the option to change locations if you decide you don’t like your location or you want to grow your business.

Buying Pro: Flexibility – Since you own your location you can do whatever you want to the building; even paint the outside neon green if it worked for your business!

Renting Pro: Initial Cost – When you rent, you aren’t going to be required to pay as much upfront versus buying your location.

Buying Pro: Additional Income – When you buy your property, you are then eligible to earn additional income due to increasing property value. You would also have the flexibility to rent out areas of your business you aren’t using if applicable and bring in additional income that way.

Renting Pro: Time Spent – If you have a maintenance issue as a renter, you call your landlord. When you own, you are left responsible for the upkeep up of the property. By renting you can focus more on your business or life outside of the business by not worrying about the upkeep.

Bottom Line

The decision will ultimately come down to what makes the most sense for you. Sit down and evaluate your goals and financial numbers and be honest with yourself. It may be helpful to gather opinions from other small business owners, but keep in mind that each journey is different. It is also worth taking the time to speak to a financial advisor or your accountant to check that your projected expenses seem accurate and on track versus your projected revenue.

Whichever option you choose, both have one thing in common – a new exciting adventure for your business.

When you started your business, did you rent or buy? Has that changed? Tweet us @SurePayroll to share your story.

Ready to give it a try?

Join the thousands of small businesses and households that trust SurePayroll for fast, easy and accurate payroll processing - for free!

Not sure what you need?

Contact us to figure it out!

Call 855-354-6941